With Congress back in their districts for August Recess, we thought it’d be a good time to talk about a some federal issues that are a high priority for Farm Bureau. First up this week: tax reform.

Congress is starting to get serious about tax reform. Both the President and leaders in Congress say they want to develop a tax reform plan this fall. But what will it look like? Will it include the things farmers need to be successful?

Agriculture operates in a world of uncertainty. From unpredictable commodity and product markets to fluctuating input prices, from uncertain weather to insect or disease outbreaks, running a farm business is challenging under the best of circumstances. Farmers need a tax code that recognizes their unique financial challenges.

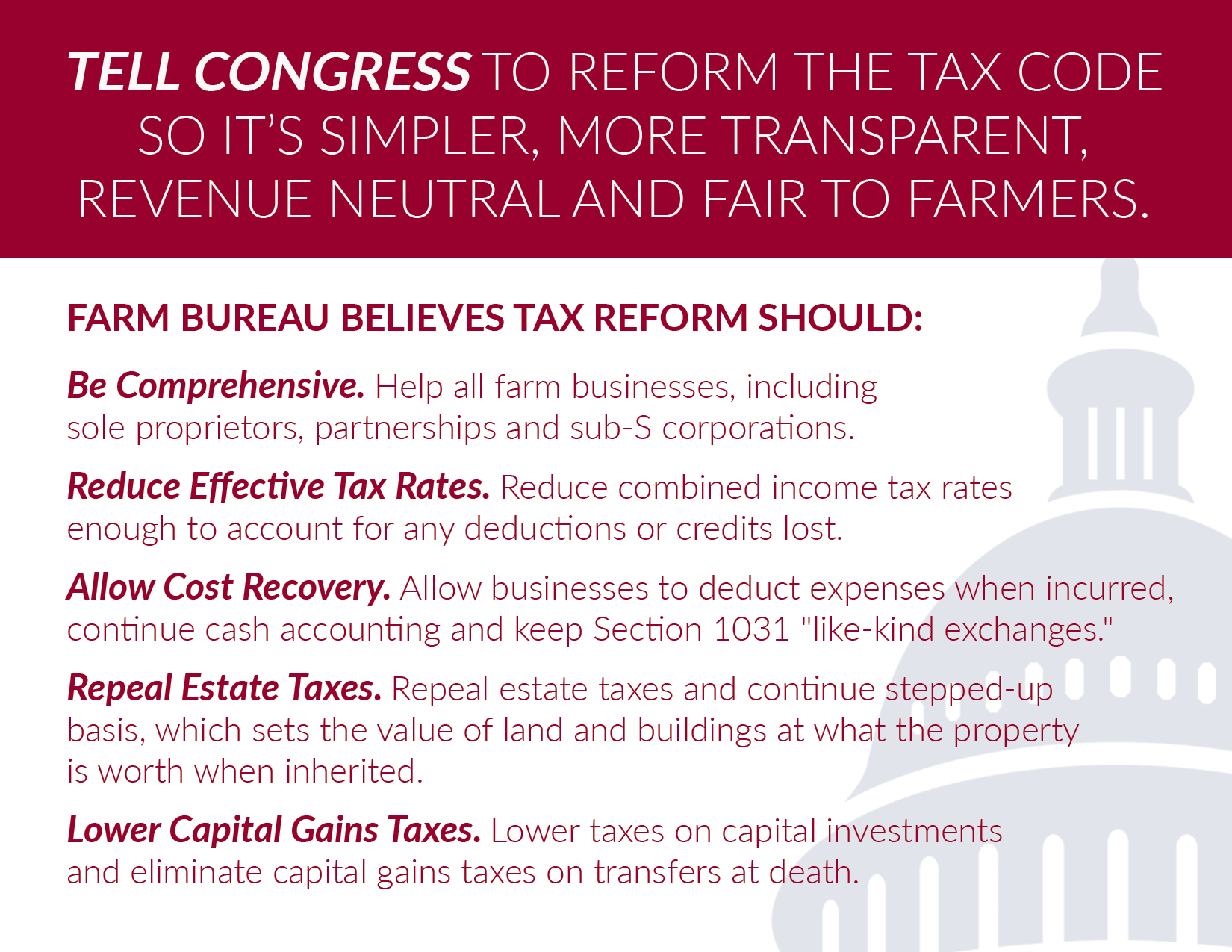

Farm Bureau supports replacing the current federal income tax with a fair and equitable tax system that encourages success, savings, investment and entrepreneurship. We believe that the new code should be simple, transparent, revenue-neutral and fair to farmers.